Awesome Tips About How To Improve Your Current Ratio

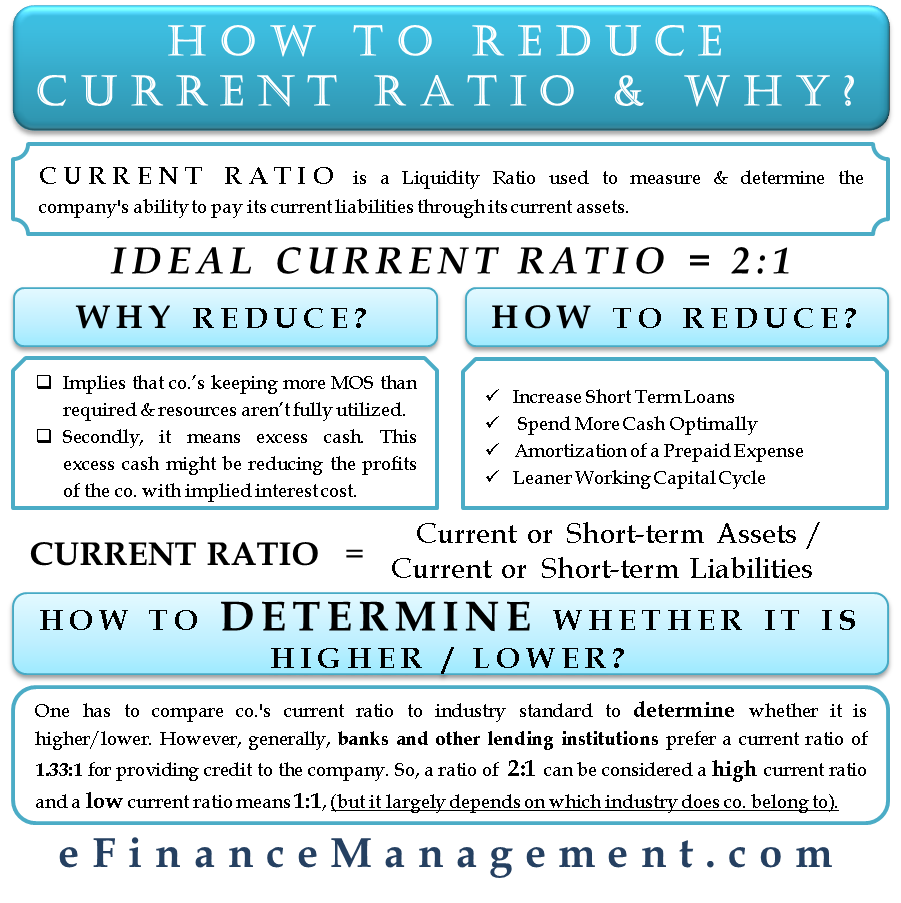

To improve your financial ratios related to liquidity, you should take a number of steps:

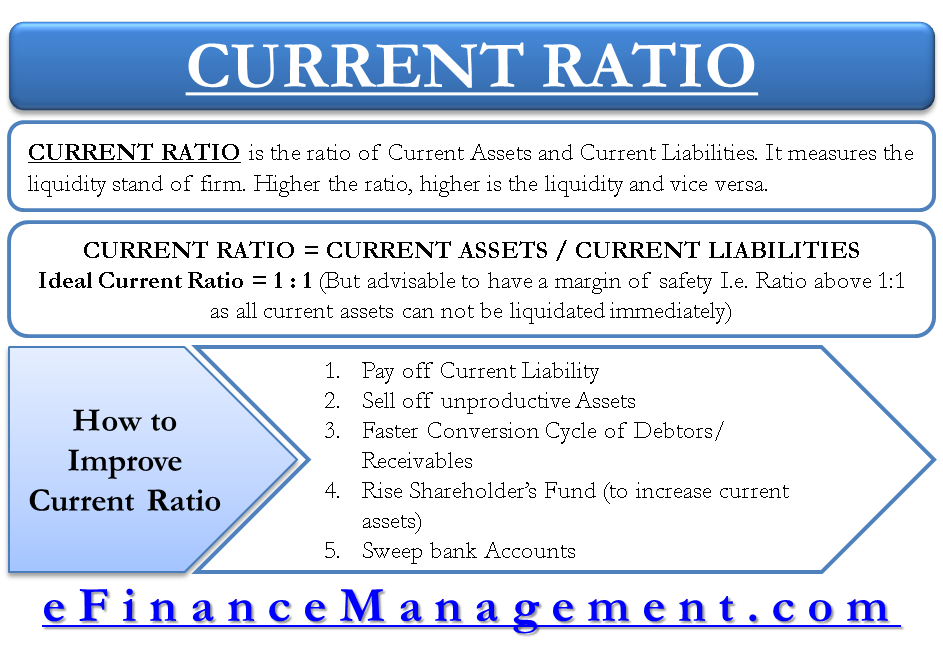

How to improve your current ratio. Add up all current assets and. Improving current ratio delaying any capital purchases that would require any cash payments. 5 negotiate for longer payment cycles:

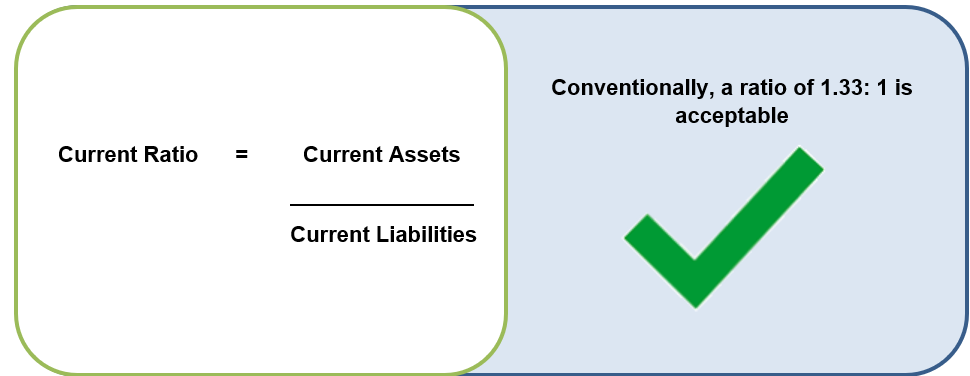

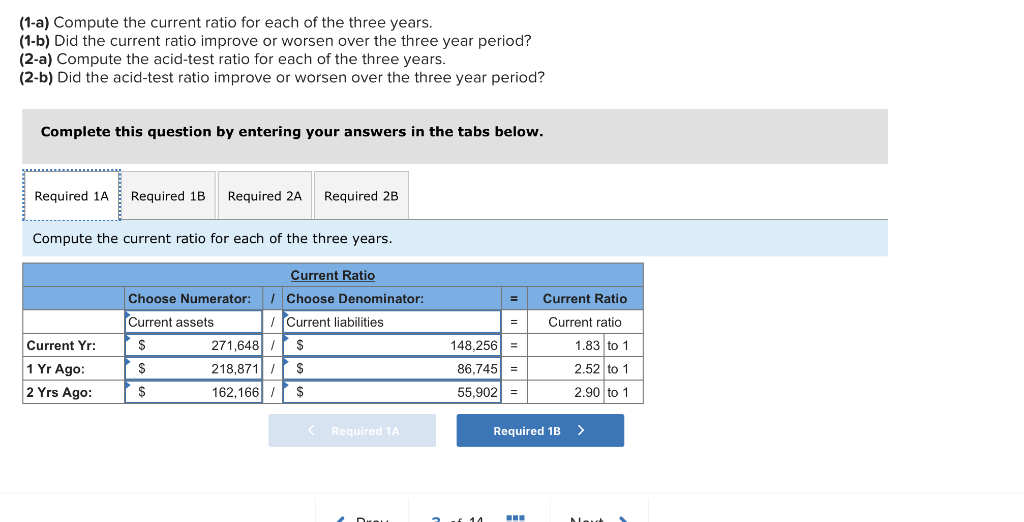

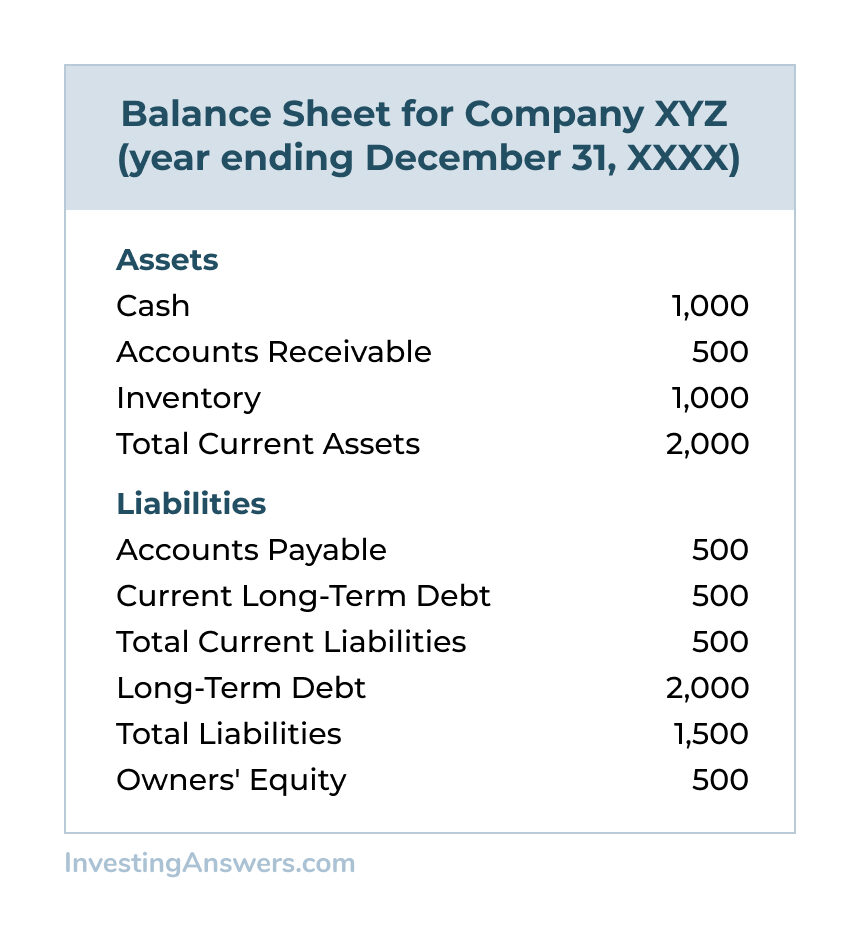

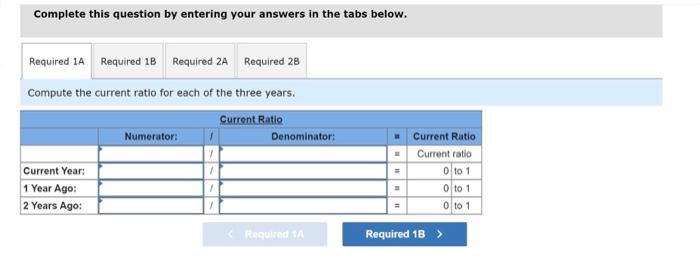

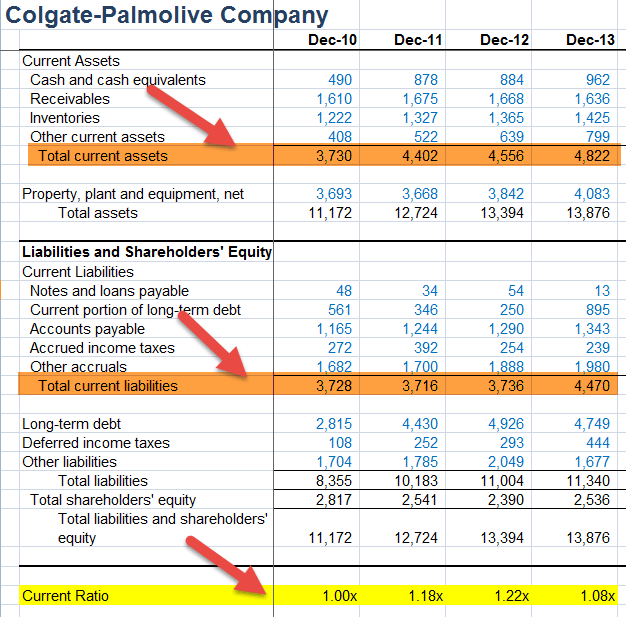

One way to quickly improve a company's liquidity ratio is by using sweep accounts that transfer funds into higher interest rate accounts when they're. The current ratio is an assessment of current assets to current liabilities. Improving current ratio the operation can improve the current ratio and liquidity by:.

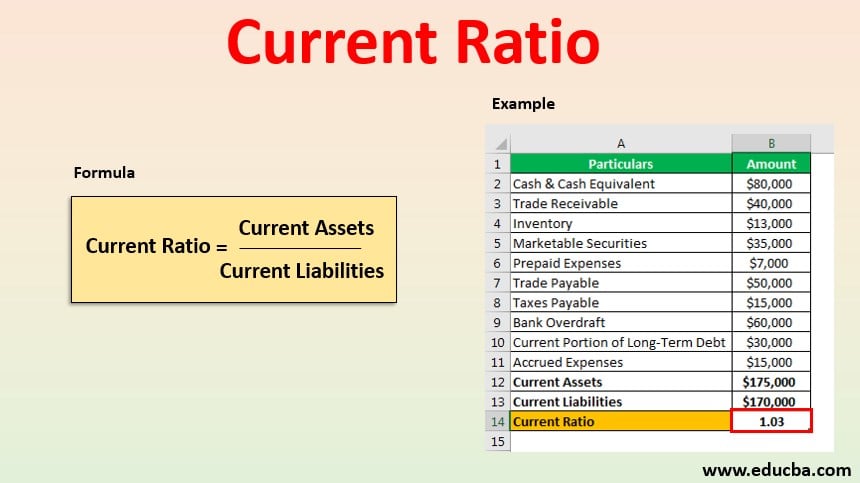

Submit your invoices as quickly as possible to your customers. How to actually understand and improve your financial ratios. If current assets = current liabilities, then ratio is equal.

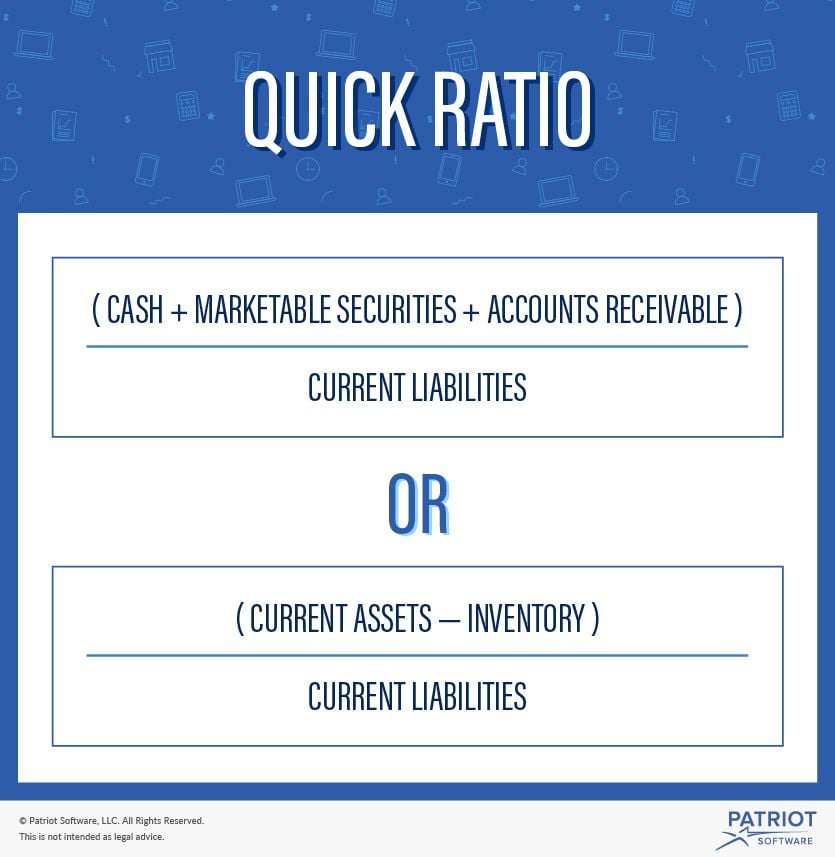

Before you can try improving this ratio, you must know what your company’s current asset ratio is. One of the quickest ways to improve the quick ratio would be to pay off the current bills and at the same time increase sales so that the cash on hand or ar increases. Analyze your short term liabilities to make sure that the debt you’re incurring is justified.

Calculate the current asset ratio. You can improve your quick ratio by doing the following: The working capital ratio formula is shown below:

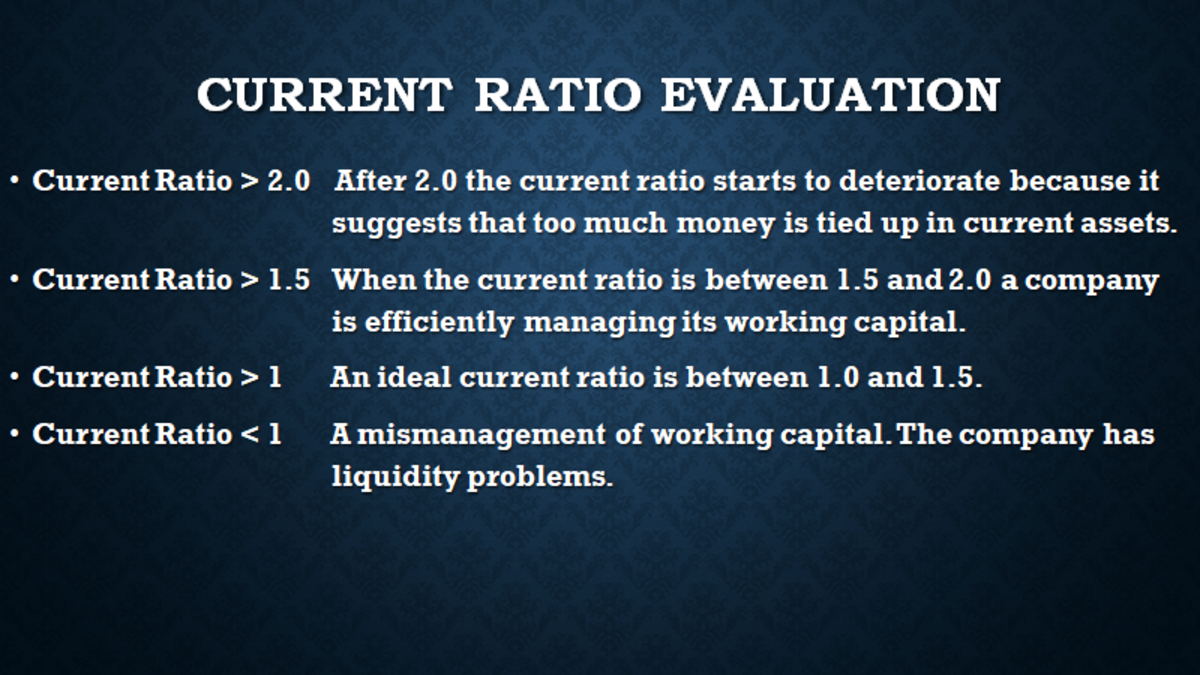

4 control your overhead expenses: The correct answer is to increase your net income and make sure to get paid on time! Improving your company’s current ratio the ideal current ratio varies by industry, but you should aim to be at or above the average in your sector.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)