Beautiful Info About How To Check On Tax Rebate

All you need is internet access and this information:

How to check on tax rebate. Will display the status of your refund, usually on the most recent tax year refund we have on file for you. On the next page, select your city or town. For the homeowner tax rebate credit, income is defined as federal adjusted gross income (fagi) from two years prior (tax year 2020), modified so that:

March 5, 2019 the best way to check the status your refund is through where's my refund? Here is the link where you can check on the status of your property tax/rent rebate: On thursday, governor glenn youngkin announced that about 3.2 million eligible taxpayers will be getting tax rebates this fall.

If you didn’t get a tax refund, the state will mail a check to the address on your tax return. Why is the state doing this? Get a refund or pay tax you owe.

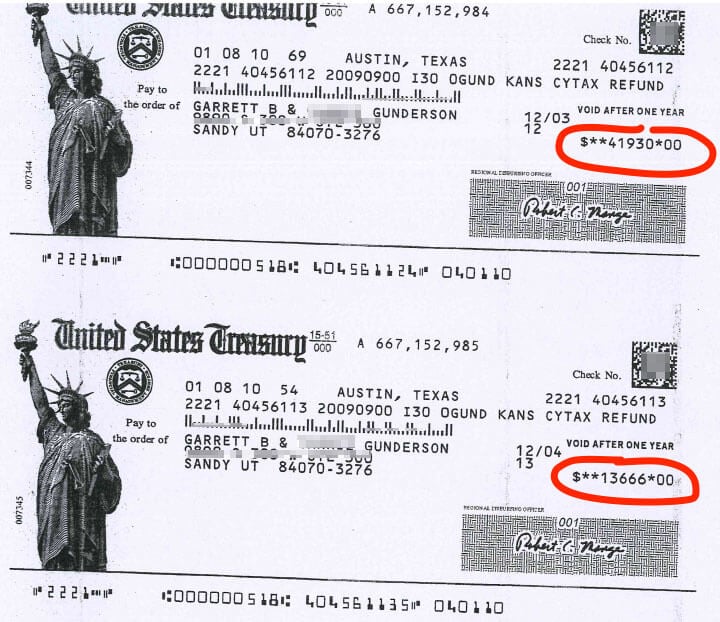

Check your recovery rebate credit eligibility. Most people who are eligible for the recovery rebate credit already received it, in advance as two economic impact payments and. The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975.

5 hours agoyou can get a refund without applying if your payments brought your loan balance below the maximum debt relief amount: Look at your 2021 individual income tax return and see if you have an amount on line. To be eligible for the payments, you had to file a state tax return for 2021 showing you still owed the state money after factoring in all deductions and credits.

The systems are updated once. Pay from your current or previous job. To find our if you’re eligible go to.