Formidable Tips About How To Apply For Resale Number

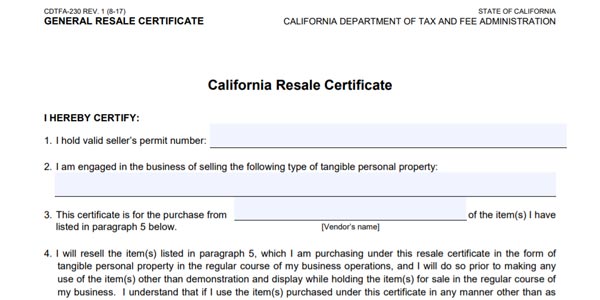

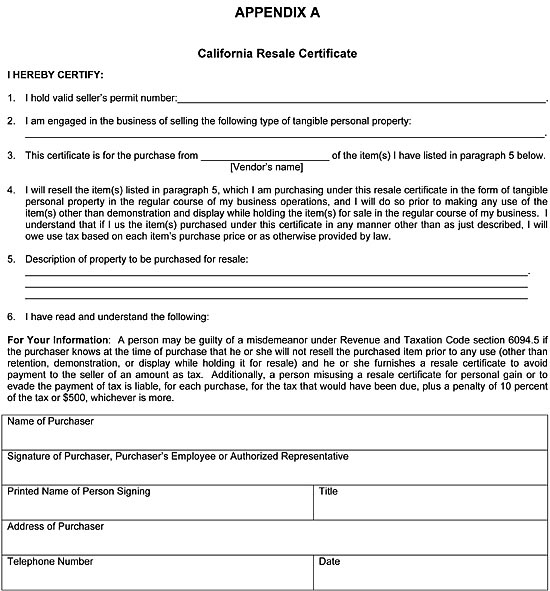

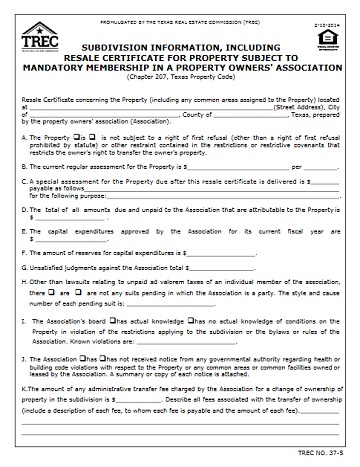

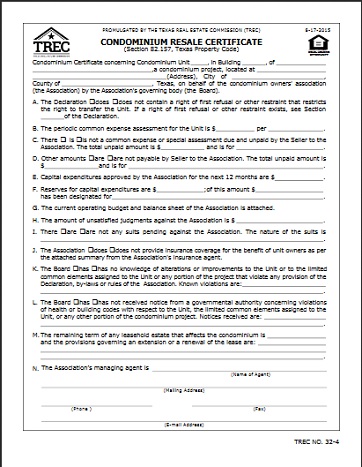

The purpose of the certificate is to document the purchase of tangible personal property for resale in the purchaser’s regular course of business.

How to apply for resale number. Resale tax number | simple online application Resale tax number | simple online application A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale.

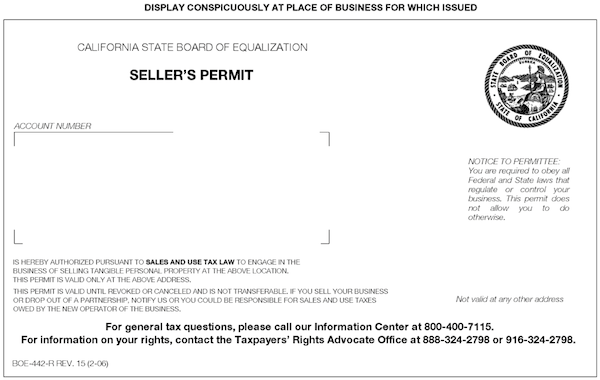

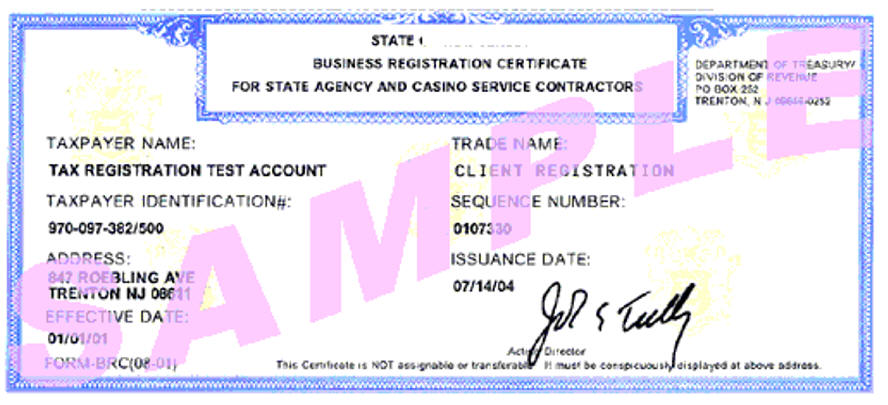

Therefore, you can complete the tax exemption certificate by providing your california seller’s permit number. This license will furnish a business with a unique sales tax number, otherwise. Go to the seller certificate verification application and enter the required seller.

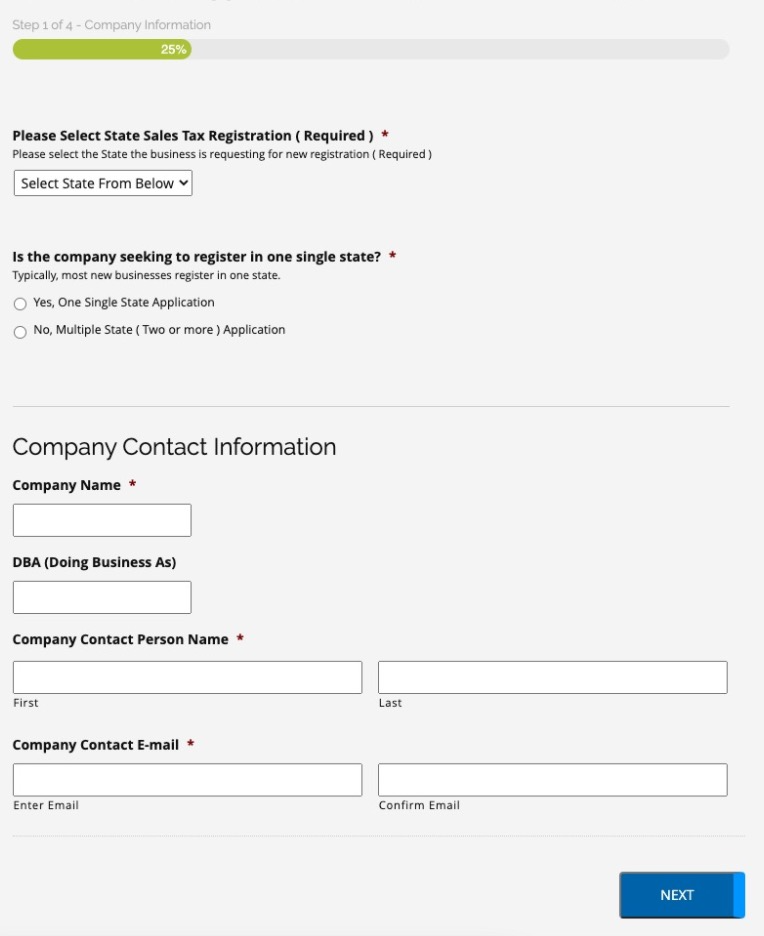

Businesses must use my alabama taxes (mat) to apply online for a tax account number for the following tax types. Businesses shipping goods into utah can look up their customer’s tax rate by address or zip code at tap.utah.gov. How to apply for a reseller’s permit in 3 easy steps.

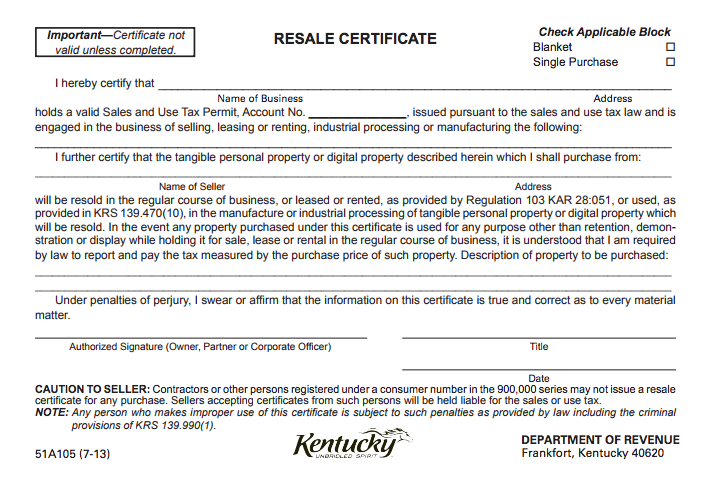

Failing to verify this information may put the liability of paying alabama sales taxes on the seller. Typically, you apply for a number from your state’s tax agency, which issues you a resale license, permit or certificate. Sales tax is then collected and paid when the items are sold at retail.

Tax rates are also available online at utah sales & use tax rates or you can. Ad resale tax number | wholesale license | reseller permit | businesses registration. As a seller, you may also accept resale certificates from others.

Resale numbers are issued by state governments. Typically, you apply for a number from your state’s tax agency, which issues you a resale license, permit or certificate. Prepare the necessary documents for your application/s.